Not all breakouts are created equal. Even when you are a favorite tech stock named Apple (AAPL). In late January, Apple shares gapped higher leading to a price breakout to new highs. In all, the move from the January low to February high was 27.7 percent. That’s a huge move for a stock with a market cap north of $700 Billion. But shares have declined of late, and the stock is in the process of testing that very same AAPL breakout level (which is now support).

In a very broad sense, breakouts either succeed or fail. But this can be further defined by your investing time frame. If you are a short-term trader, you want to get in, use a trailing stop, and ride a breakout higher (taking profits along the way). If you are an intermediate to longer term investor, you want to use breakouts to either add immediately, or upon a retest (reducing exposure at higher levels).

And in either case, active investors of all types likely want to begin thinking about reducing exposure if the breakout doesn’t hold.

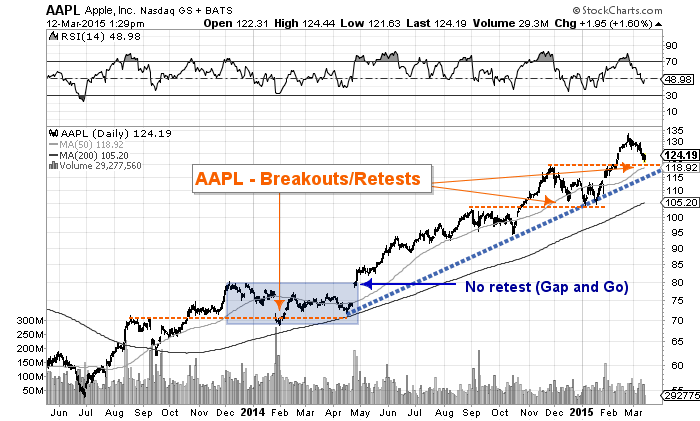

Over the past 2 years, there have been 4 “macro” breakouts on Apple’s stock. Note that 3 of them (including the current setup) have seen their respective AAPL breakout levels retested (and the prior 2 have been successful). The other breakout was a gap and go (that occurred without a retest – also a success).

In the broader scheme of investing, retests offer important insights regarding near-term and intermediate-term trend confirmation. And this can help with crafting risk definition and exposure. That said, one may want to think about the current AAPL breakout level in terms of their entry point and time frame. If you have a wider lens then perhaps you want to give it some wiggle room and/or use in conjunction with other indicators. Note as well that the 50 day moving average is near the breakout level and trend line support is around 115.

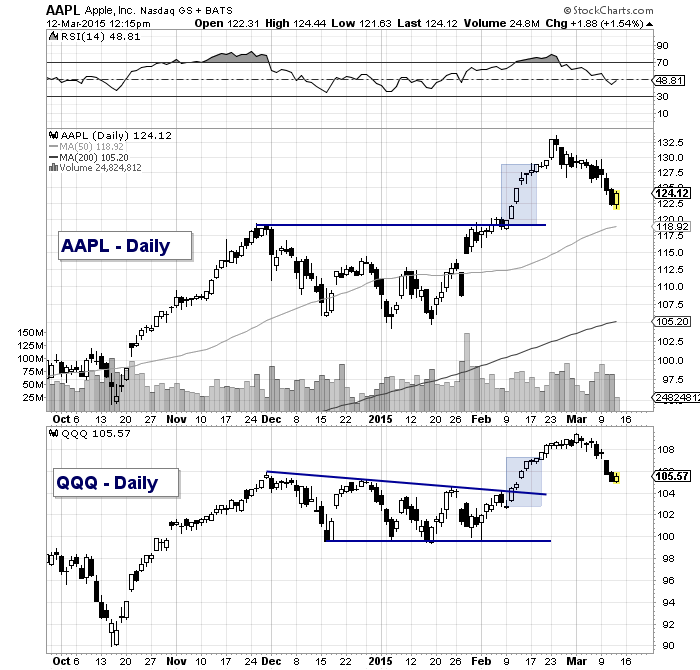

It should also be noted that Apple’s market cap makes it a major market mover. And just as Apple carried the tech sector on its back during the Nasdaq’s move above 5000, it can weigh just as heavy on the index during a period of correction.

Currently, the Nasdaq 100 ETF, Powershares QQQ Trust (QQQ) is undergoing a similar retest. How this plays out may determine the market’s next move (and Apple’s).

If you like price analysis, check out James Bartelloni’s recent piece on Apple’s wave 3 price targets. Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

Author has a position in QQQ at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.