Despite the excitement surrounding the S&P 500 briefly touching all-time highs on Monday, the market has yet to demonstrate proper follow-thru or confirmation that a new uptrend has begun. See It Market contributor Andrew Thrasher did a great job of highlighting several non-confirming divergences yesterday.

Despite the excitement surrounding the S&P 500 briefly touching all-time highs on Monday, the market has yet to demonstrate proper follow-thru or confirmation that a new uptrend has begun. See It Market contributor Andrew Thrasher did a great job of highlighting several non-confirming divergences yesterday.

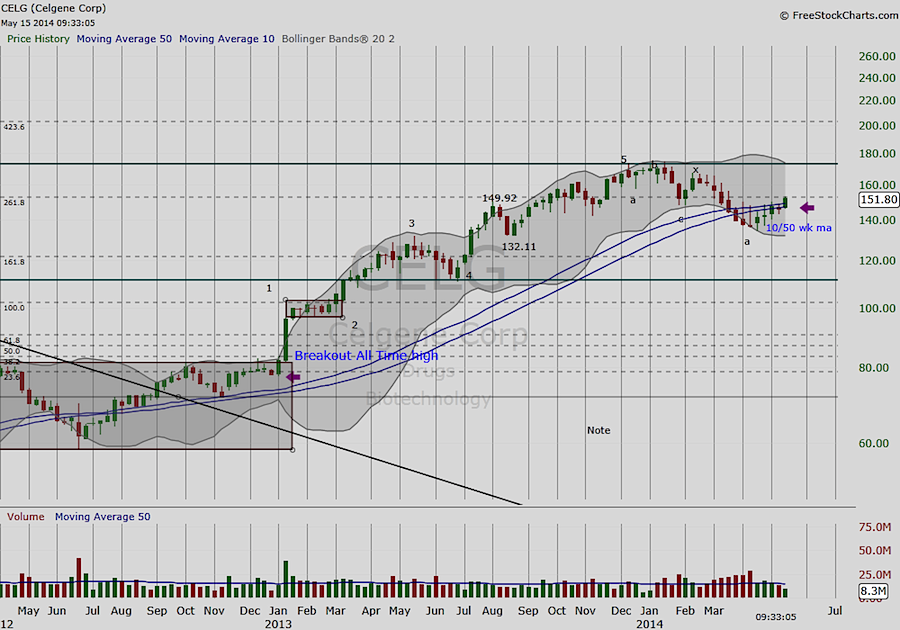

The rotation is well underway and many of the old leaders are down while defensive names are up. It can be a challenge in this environment to find stocks trading near pivotal points. However, one stock that fits this criteria is Celgene Corp (CELG).

Figure 1, CELG Weekly Chart – FreeStockCharts.com

Chart Highlights

CELG has become a household ticker for growth traders who follow strong sectors and strong earnings. In early 2013, Celgene stock broke out above its all-time high with little rest until earlier this year. Today, despite benefiting both from good earnings growth and as a member of the long favored Biotech sector, we can see from Figure 1 that CELG stock has steadily sold-off since late February. Today, the bears and bulls continue their battle for control, and we find Celgene’s stock price at its pivotal 10/50 week moving average. The 10/50 week moving average is an important long-term support structure for longer term traders/investors. For the bulls it is a support line, for bears it is a resistance line. Either way, the line in the sand is clear regardless which side you favor.

Elliott Waves and Potential Support Area

The fifth wave in Celgene’s run was extended as shown in Figure 1. If CELG breaks downs, and we can expect the bulls to shore up support near the 4th Wave. Look left, and volume is slightly elevated at this level, confirming a potential congestion zone. Thank you for reading.

Author holds no positions in securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.