Cardtronics Depressed Multiple May Be Underestimating Potential in Growing ATM Industry

Cardtronics (NASDAQ:CATM) is a $1.92B provider of consumer financial services via ATMs and kiosks. Cardtronics stock price has gained 27.3% YTD but remain below 2013 highs of $44.55. Cardtronics (CATM) is the #1 non-bank deployer of ATMs in the world, a global market seeing 5% unit growth and 6% transaction growth. It owns 195,000 ATMs that do $1.6B in annual transactions with 66% exposure to the US and 27% to the UK. Its ATMs are located at various Retailers as well such as Target, Kroger, 7-11, Walgreens, Costco and CVS, so it is a bit dependent on retail traffic. The global installed base of ATMs is currently near 3.4M and expected to reach 4.1M in 2020, and CATM accounts for just 6% of units and 1% of transactions, leaving a large opportunity to take market share. Its goal is to become the preferred ATM network for businesses around the World.

CATM shares trade 14.2X Earnings, 1.58X Sales, and 5.25X Book, and has generated 17% revenue CAGR the last two years. Cardtronics has plenty of attractive attributes such as a diverse and recurring revenue stream, expanding margins, strong free cash flow, and a proven history of earnings/revenue growth both organically and via M&A. Organic growth in Q1 2016 was 9% (partially driven by large Powerball Lottery), its best level since 2012, and EBITDA margins have expanded to 26% in 2016 from 22% in 2009 while EPS has posted 20% annual growth. They also posted 7% “same store” revenue growth in the US. Cardtronics was generating double digit revenue growth 2010 through 2015 and in 2016 expected to only grow 5%, while EPS a similar situation with 15%+ annual EPS growth coming down to 8.6%. I would expect Cardtronics to look to M&A to reaccelerate growth, as current analyst models see 2016 as a peak revenue and EPS year for the company. In April the Company announced plans to acquire 2,586 ATMs from Chase located primarily in high-traffic retailers. The coming quarter could see a slowdown Q/Q due to the Powerball effect from the previous quarter. Cardtronics stock (CATM) is trading 7.8X EV/EBITDA while Diebold (DBD) at 7.8X and NCR Corp (NCR) at 6.5X. CATM is looks cheap to its peers considering its better growth and margin profile.

On another note, there has been M&A activity in the ATM industry. In November 2015, Diebold (NYSE:DBD) agreed to purchase Wincor Nixdorf for $1.9B, taking market share to 25%. NCR Corp (NYSE:NCR) has a 25% market share, and in November secured an $820M investment from Blackstone after talks earlier in the year of a potential full acquisition. The cash infusion could have NCR looking for an acquisition such as Cardtronics to regain market share. Nautilus Hyosung, based in Korea, is the next largest ATM player.

Analysts have an average target of $42 on shares with 4 Buy, 2 Hold, and 1 Sell rating, Street high target of $46 and low of $36.

Short interest is 12.9% of the float, but has dropped 32.4% over the last 3 months. Options activity in the name is generally quiet, but on 7/14 there were a few unusual trades including 250 August $45 calls bought at $0.80 to $0.90, 500 September $45 calls bought at $1.20 to $1.25, 250 September $40 puts sold to open at $0.95, 250 December $35 puts sold to open at $0.70, and 250 December $40 puts sold to open at $1.80. Institutional ownership fell 2.19% in Q1 filings with 27 funds taking new positions, 83 adding, 25 exiting, and 80 reducing. New South Capital, a $4.16B fund out of Memphis, added over 900K shares in Q1 and CATM is now its 18th largest holding. Van Berkom & Associates out of Montreal owns Cardtronics stock (CATM) as its 6th largest holding.

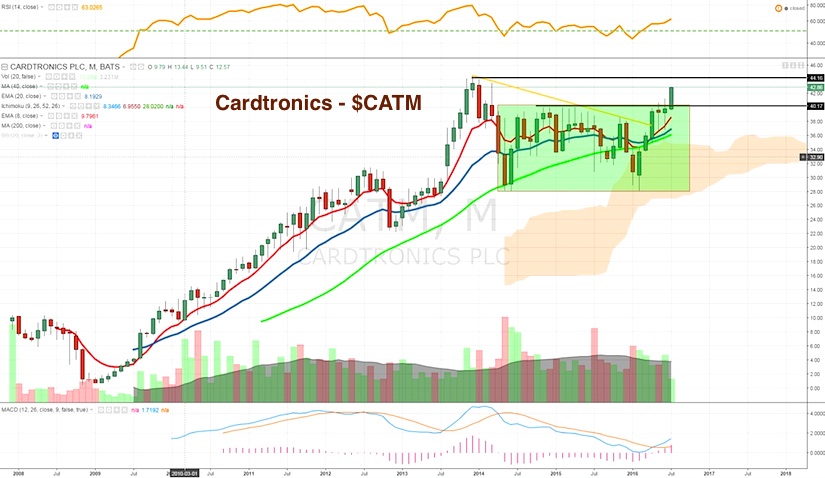

Looking at Cardtronics stock chart, you can see that CATM shares broke out of a weekly bull flag this week past major $40 resistance and can now aim for a return to the 2013 highs. Shares spent a long time in the $28/$40 range, and now with the momentum can target a measured move to $52.

Cardtronics Stock Chart – $CATM

It is important to analyze the risks with any investment thesis, and there are quite a few I see with CATM:

- Does the evolution of mobile payments threaten transaction growth of cash based trade in a move to a “cashless society”?

- Does slowing traffic in the Retail industry cause a meaningful slowdown to merchant ATM usage?

- If organic growth is limited, are there suitable accretive growth M&A options?

- What is the long term impact of losing its largest customer, 7-Eleven, a contract expiring July 2017?

In closing, with those risks in mind, CATM still looks attractive in my eyes at this multiple with a strong proven track record. Cardtronics also has room for market share and margin expansion helped by its growing scale. The company is capitalizing on a secular trend of banks wanting a less expensive way to extend their brand and cash access offerings. Although domestic growth may have peaked, the company showed impressive growth in Europe and is actually moving its headquarters to the UK to focus on international growth. One risk mentioned was digital/mobile, but this could actually be a positive for Cardtronics as banks look to reduce physical presence, but still have ATM access for attracting/retaining customers. In an industry that is dominated by 2 large players, Cardtronics stock sticks out as the best name to capitalize on positive trends in the ATM industry. And it could also find itself as a M&A target after years of being an acquirer.

Twitter: @OptionsHawk

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.