The decline in biotech stocks through summer and autumn isn’t over just yet. Even so, there may be an opportunity to shop for a “value buy” within that time period which could produce very rewarding gains for an investor who is prepared to ride through some chop in the biotech sector.

Here we show some of the decision points in relation to the S&P Biotech Sector ETF (XBI).

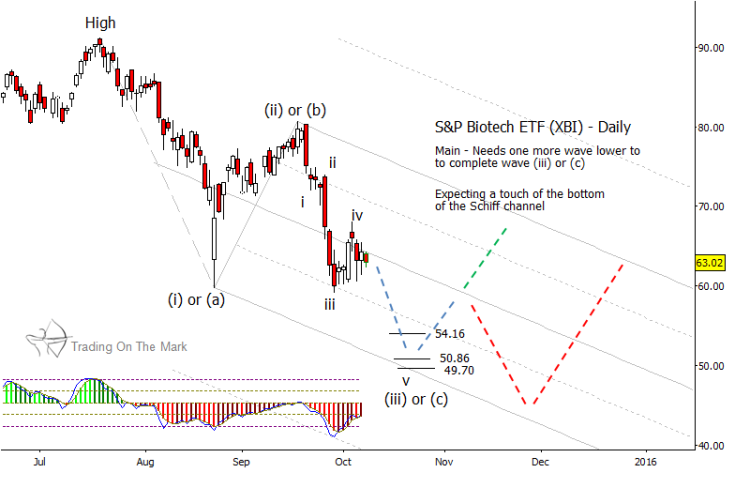

Based on the internal structures of the decline from July to August and the more recent decline from mid-September, our Elliott wave analysis suggests that the price of the Biotech Sector ETF (XBI) can reach lower this month. We have calculated some Fibonacci-based support targets for the present leg of the decline near 54.16, 50.86 and 49.70, as shown on the daily chart below.

If price reaches that area, XBI will have declined approximately 35% to 45% in value from its summer high, suggesting a severely oversold condition.

If price bounces from the support area, it could face the first big decision point near the center line of the Schiff channel shown above. Or, perhaps more importantly, near the August price low which we have labeled as wave (i) or (a) at 59.85.

Breaking above the August low will ensure that the entire move down from the summer high is not impulsive and will allow for price to test higher for several months or possibly longer. So this is an important overhead level to be aware of. This more positive pattern for the Biotech Sector ETF is shown with the green path we have drawn on the chart.

On the other hand, if a bounce gets rejected at the decision area, it may result in lower lows near the end of the year. However, that would be a setup for taking a long position in preparation for a larger wave (ii) bounce. This is depicted with the red path we have drawn on the chart above.

Neither of the scenarios shown on the chart makes a strong case for new highs in 2016. Regardless of that, we believe a sizeable upward move is in store for the patient trader. And for that reason, we have the Biotech Sector on our radar. Let us help you target your trades – visit Trading On The Mark today! Thanks for reading and have a great weekend.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.