Stocks ended the month of July with a bang, wiping out all the month’s gains and much of June’s during the final five sessions. This was definitely a different vibe from the markets, as we haven’t seen heavy month-end selling for some time. As suspected, investors are on the defensive heading into August. And many are wondering if this stealth drop will develop into a deeper correction?

Stocks ended the month of July with a bang, wiping out all the month’s gains and much of June’s during the final five sessions. This was definitely a different vibe from the markets, as we haven’t seen heavy month-end selling for some time. As suspected, investors are on the defensive heading into August. And many are wondering if this stealth drop will develop into a deeper correction?

On the surface, it doesn’t look too bad. All told, the S&P 500 dropped 1.5% in July. But this doesn’t come close to telling the whole story. Under the surface, the markets have been de-risking (of sorts) in fits and starts, favoring large caps over small caps… July being a great case in point: The Russell 2000 was down 6.1% for the month. Andrew Kassen and myself (amongst others) have been honing in on this theme for some time. Check out Andrew’s deep-dive research on the Small Caps, as well as my research on large caps for reference.

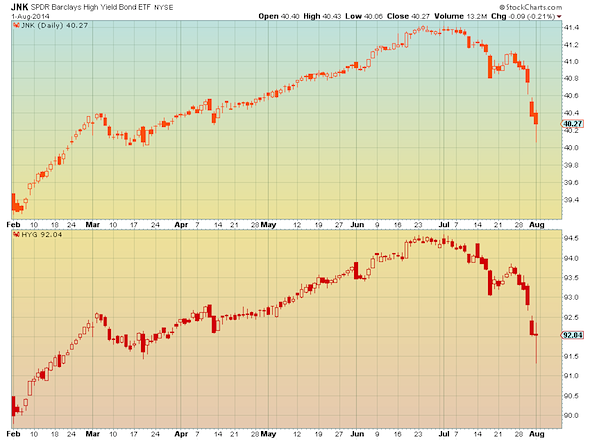

As well, high yield/junk bonds started to rollover in early July… this was/is an important indicator to watch as credit often precedes equities. Below are the charts for Barclays High Yield Bond Fund (JNK) and iShares High Yield Corporate Bond Fund (HYG):

These warning signs and others (TLT, XRT, VIX, etc…) were highlighted by Robert Lesnicki early last week in his research post on potential warning signs for investors. Other areas to watch include sentiment and margin debt… these two items were covered extremely well by fellow contributor Ryan Detrick – another must follow.

Heading into August, perhaps the theme will be, “Whatever happens in August stays in August.” Kidding aside, it does appear that August will see some volatility chop as investors tread lightly and attempt to gauge the strength of any rally attempt. Note that the stealth downdraft of late may have caught a tradable bottom on Friday (ref: Chris Burba’s S&P 500 market breadth study)… but the prospect of another wave of selling (and headline risk) should keep investors focused.

Okay, time to reflect on some of the best posts for the month of July in our latest installment of The Best of See It Market. As always, thank you for your readership and please do not hesitate to provide feedback.

THE BEST OF SEE IT MARKET – July 2014

- Bradley Timing Model Indicates July 2014 Turning Point by Alex Bernal

- Take A Long, Hard Look At The Russell 2000 by Andrew Kassen

- Is Investors Intelligence Poll Sounding A Contrarian Alarm? by Ryan Detrick

- Large Cap Stocks Defining Risk-On In 2014 by Andrew Nyquist

- Happy Days Are Here Again… Or Are They? by Chris Kimble

- July Seasonality: Strong And Weak Trending Stocks by Robert Lesnicki

- Follow The Leader: What’s Next For The Nasdaq 100? by Andrew Nyquist

- Why Crude Oil Is Back On Investors Radars by Maria Rinehart

- Will Small Caps Continue To Weaken? by Andrew Thrasher

- Why The VIX Could Stay Low For Years by Ryan Detrick

- Semiconductors: Is The Charge About To Die by Andrew Kassen

- Gold Analysis Without The Noise, Just The Fibs Ma’am by David Busick

- Is The Stock Market Starting To Show Some Cracks? by Jeff Voudrie

- Managing Risk Through Unforeseen Events by David Fabian

- S&P 500 Study: Bounces Follow Drops In Market Breadth by Chris Burba

Look for another installment of “The Best of See It Market” next month.

Twitter: @seeitmarket