The broader stock market had to scratch and claw its way higher in 2014 and early 2015. And as with any market, some sectors lead and others fell behind. The problem: “defensive” sectors lead for much of last year. And it’s also widely known that when “defensive” sectors lead, it’s a caution flag for investors. A healthy market likes to see cyclicals (like bank stocks) involved as this typically signals stronger underlying fundamentals (for both the market and the economy).

The back half of last year was particularly unhealthy, culminating in the October, December, and January pullbacks along with an uptick in market volatility.

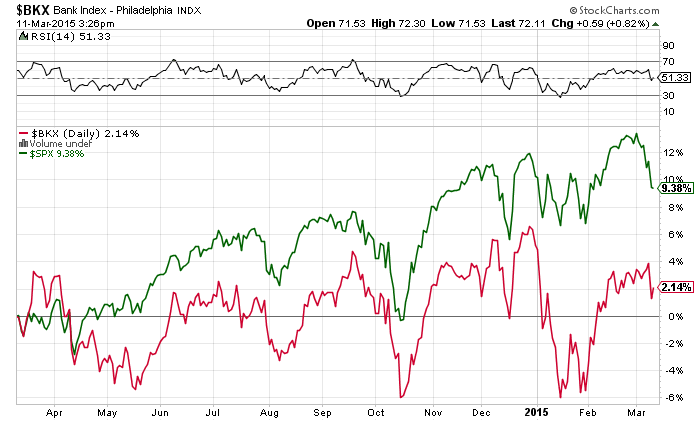

One sector that wasn’t participating throughout the better part of last year was the banking sector. And although investors still have a hard time swallowing bank stocks after 2008/2009, it is (and always has been) a good sign to see the banking sector leading the broader market higher. Below is a chart of the Bank Index (BKX) vs the S&P 500 over the past year. As you can see, the banks had trouble keeping up with the S&P 500. And in fact, the banks offered a recent non-confirmation as the S&P 500 made new highs while the Bank Index did not. This indicates that the banks are still in an uphill climb from a macro perspective.

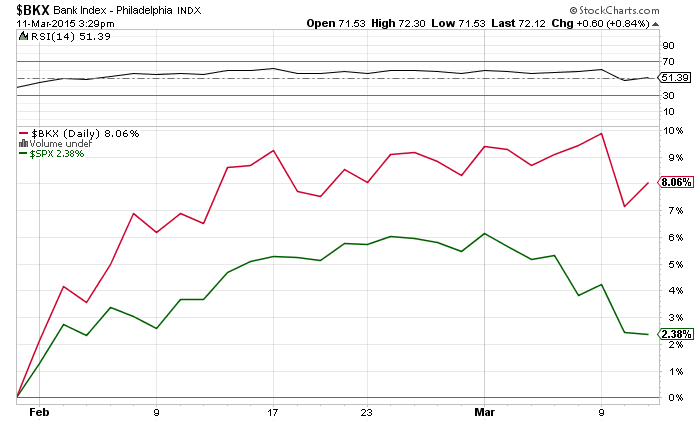

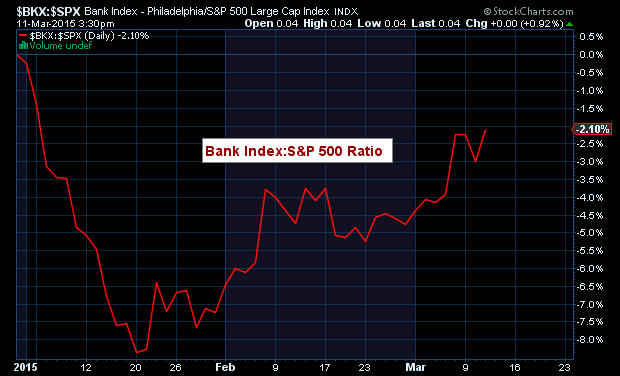

That said, bank stocks have been showing some signs of life in 2015. Since late January, the performance gap has disappeared as the Bank Index has begun to outperform (European QE appears to be have given ailing banks new life). This setup isn’t actionable by itself, and may prove fleeting altogether, but it should be monitored for development over the coming days/weeks. If the market is going to turn around and go higher, it will likely need the banks. Continued outperformance would be a start, but ultimately the Bank Index will need to make new highs to confirm a new trend higher.

Bank Index (BKX) vs S&P 500 (SPX) Performance Chart – since February 1st

BKX:SPX Relative Strength Ratio Chart YTD

One “big” bank stock that has showed considerable strength is Wells Fargo (WFC). But there’s also been quite a bit of disparity (and variety types) within the broader banking sector, so active investors will want to do their homework before selecting any individual bank stocks. Another way to monitor the sector in a broader sense is through the Financials Sector ETF (XLF).

For now, investors can use the Bank Index as a macro indicator for the overall health of the market. It’s nice to see the recent strength in bank stocks, but if there isn’t any continuation or follow through, then it will prove to be of little import. Thanks for reading

Follow Andy on Twitter: @andrewnyquist

Author has a position in SPY at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.