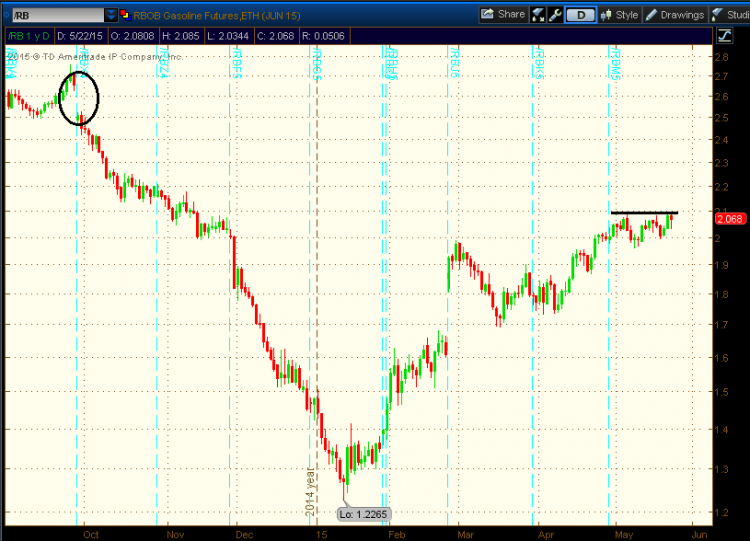

RBOB Gasoline prices increased 69 percent from the January low, while Crude Oil only moved higher by 41 percent. The so-called boon to consumers of cheaper gas prices is slowly whittling away. What’s interesting is the apparent relative strength of gasoline prices versus Crude Oil if you look a bit more historically.

For instance, if crude oil were to double from the current level, it would be at $120 – still some $27 below the peak in July 2008. If RBOB gasoline prices were to double, it would be at $4.14, a whopping 50 cents above its 2008 high. The difference between crude oil and its refined products is known as the ‘crack spread’ and is often closely monitored and forecasted by fundamental energy analysts. Companies like Tesoro Corporation (TSO) and Valero Energy Corporation (VLO) tend to like when this spread widens. TSO and VLO share prices have done quite well versus the overall stock market in the last few years, not surprisingly.

Turning specifically to RBOB gasoline – it appears to be bullishly consolidating at the moment, perhaps poised to make another leg higher. The $2.10 level is resistance. In terms of upside targets, there is an old gap to fill from last September near $2.65 (this gap is due in part to a new prompt month contract rolling out at that time). Unfortunately for US consumers, a $2.65 price on RBOB would mean about $3.30 per gallon at the pump.

Seasonally, RBOB tends to begin to struggle this time of year, contrary to popular thinking that prices continue to increase through the 4th of July holiday. The below chart (credit to Signal Financial Group) aggregates the past 20 and 30 years of RBOB prices into average calendar years.

The chart of RBOB continues to look constructive, and a move above $2.10 would help confirm bullish momentum. So keep an eye on gasoline prices and that crack spread!

Twitter: @MikeZaccardi

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.