We have looked at asset based valuation and calculated intangible value, and in this article we will look at the P/E valuation method (price to earnings). It is the most commonly used way to value an entity. And it is simple to calculate:

We have looked at asset based valuation and calculated intangible value, and in this article we will look at the P/E valuation method (price to earnings). It is the most commonly used way to value an entity. And it is simple to calculate:

Company value = post-tax earnings x P/E

Breaking this down, we know that the P/E ratio is the share price of the entity divided by its earnings per share. We also know that a high P/E ratio reflects the market’s optimism regarding the future growth of the company. If the company isn’t listed, then a proxy P/E ratio may be used. This may not be straightforward to discern but is also important when looking at listed entities as merely applying their own P/E ratios to earnings will result in the current share price. Caterpillar Inc (CAT) is a good example of how difficult this can be, as it operates across a number of sectors.

Another key issue is that the EPS for a company, and its published post-tax earnings, are historic and may not be suitable for valuation purposes. Recent earnings are a valid starting point though and the prospective acquirer may make some adjustments to arrive at a more practical value for future earnings. The most obvious is to look at any synergies which would result from the takeover. You would hope that this would be a material amount or there may be little purpose to the activity. Considering Directors’ salaries may alter the figure as well, these may change post-takeover. There are other areas to look at, such as capital structure, which may change, and any non-recurring items which have been reported.

As you would expect, there are a number of points to consider when using the P/E valuation method. We have noted that the information is historical, it is again based on accounting profit rather than cash flow, and determining a proxy P/E ratio is difficult. Looking at the earnings, can we be sure that they are sustainable? On a positive note, they are commonly used and are useful when looking at taking a controlling stake in an entity.

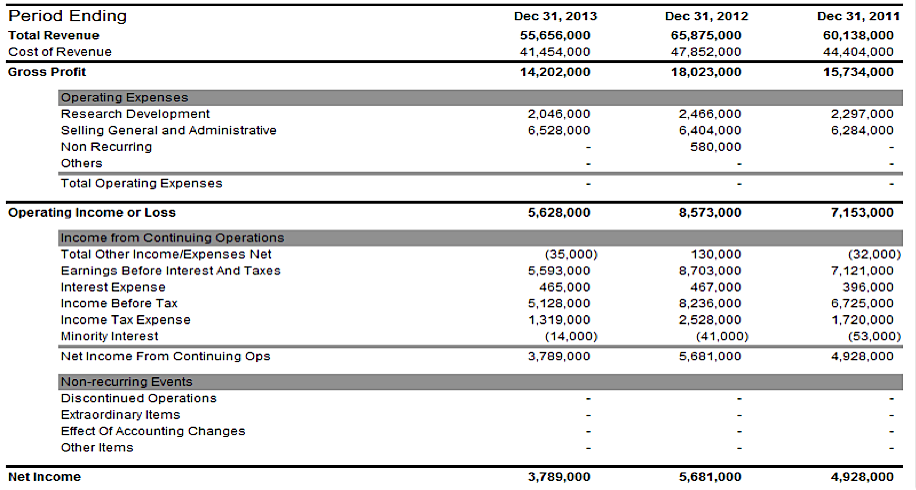

Using our example of CAT, we can see that an adjustment to the calculation could have been made for the 2012 year end as there was a non-recurring item.

Figure 1: Yahoo Finance – Cat Income Statement

In this series, we still have to cover the Dividend Valuation Model and Discounted Cash Flow but there are some other important issues to cover related to valuation, the Cost of Capital and the PEG ratio, and we will look at these in the context of CAT in my next article.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.