The two day selloff has put several stocks on notice. Right now, active investors should be doing two things: managing risk and preparing for opportunity. Managing risk relates to current trading and investment positions, while preparing for opportunity focuses on price levels for new ideas and potential additions to existing positions. One stock that many investors have on their radar is Apple Inc. (AAPL – Quote). I often cover the stock and figured that the New Year was as good a time as any to provide an update on the Apple stock pullback.

The two day selloff has put several stocks on notice. Right now, active investors should be doing two things: managing risk and preparing for opportunity. Managing risk relates to current trading and investment positions, while preparing for opportunity focuses on price levels for new ideas and potential additions to existing positions. One stock that many investors have on their radar is Apple Inc. (AAPL – Quote). I often cover the stock and figured that the New Year was as good a time as any to provide an update on the Apple stock pullback.

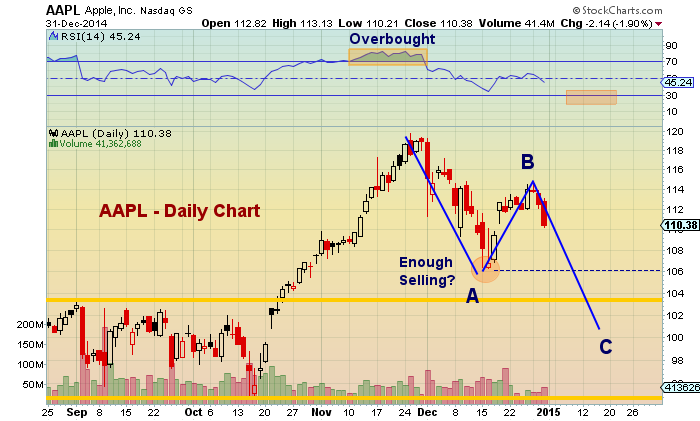

My previous post questioned whether Apple was a buy on this pullback. And the premise was that the stock needed to hold the lows from December 16th ($106.26). It has done that thus far, but the pullback / consolidation period has lasted a bit longer than most analysts would like (the intraday high came on November 25th).

So what should we be watching for with this Apple stock pullback.

- The early November congestion zone around $108-$109. A break below $108 should warn of lower prices.

- As mentioned above, the December 16th low at $106.26. It will be a bad sign if we see this level again, and may warn of a retest of $100.

- Measured move target (A-B-C) at $101.28. See the daily chart below. This is also in the thick of a $97 to $103 congestion zone.

- Big open gap down at $99.76.

- The rising trend line. This critical support comes in around $95 and rises up near $100 by the end of January.

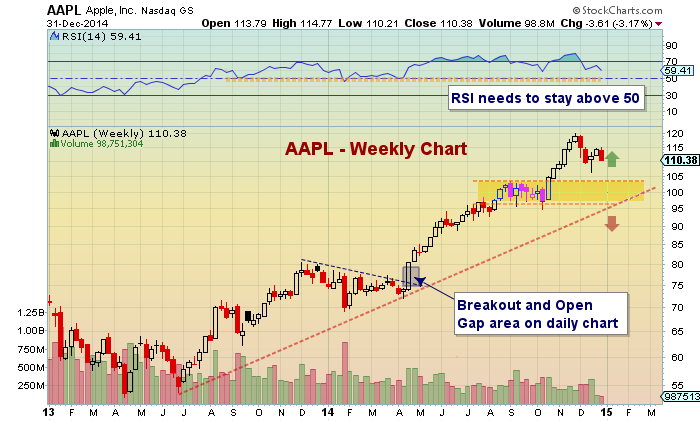

Lastly, it should be noted that 50 on the Relative Strength Index (RSI) is an area that I like to see stocks hold (during rally phases or swing trades). This was broken on the daily chart (short -term), warning of lower prices. BUT, the weekly chart (intermediate term) is still at 59.41.

Apple Stock Chart – Daily

Apple Stock Chart – Weekly

Lots of folks are raising Apple price targets to much higher levels… $130, $140, or even $150 per share and beyond. These targets are quite possible, but getting your entry position correct and managing around existing positions are keys to success.

The price action over the coming days will be important. Additional weakness may hint at a retest of the $100 level, where an A-B-C measured move coincides with the rising trend line and congestion support. Trade safe.

Follow Andrew on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.