By Andrew Kassen On Monday we considered whether the already beaten-down Apple could bounce or had still further to fall (check out that post here). In light of Apple falling down with the important break underway beneath $420 support today, let’s recall both the general landscape and specific support levels below with a series of updated charts:

By Andrew Kassen On Monday we considered whether the already beaten-down Apple could bounce or had still further to fall (check out that post here). In light of Apple falling down with the important break underway beneath $420 support today, let’s recall both the general landscape and specific support levels below with a series of updated charts:

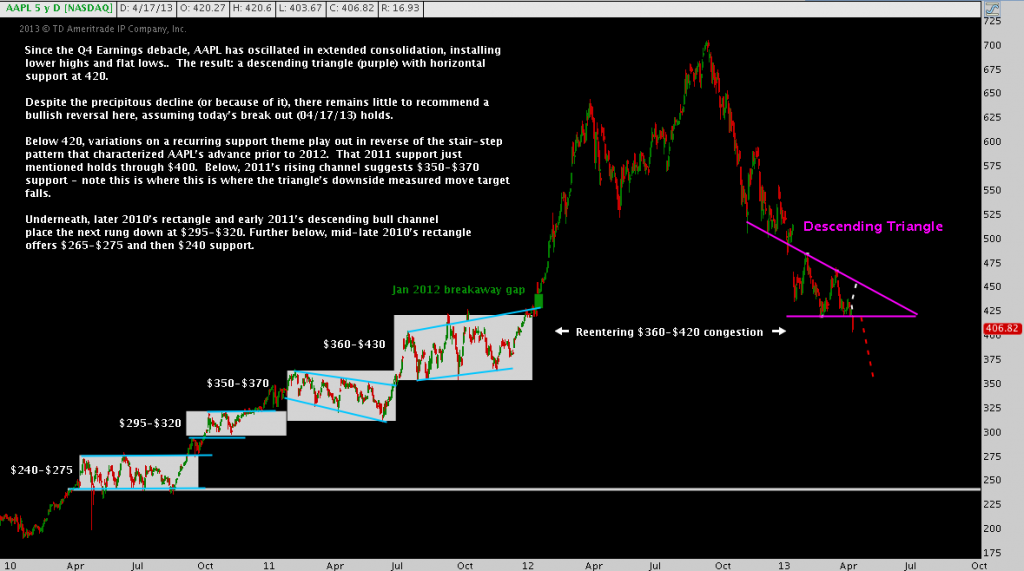

Apple’s post Q4 Earnings Descending Triangle was defined by the support at $420 that is now breaking. See It Market readers will recall Andy Nyquist’s analysis prominently featuring this level a month ago. On Monday we pointed out the Inverse Head & Shoulders bottom that appeared to be forming (but was not yet an activated pattern beneath $435). The promise of that pattern fell through, turning from a potential rally to $460 into a feeble partial rise back to triangle resistance. In other words, what signified possible strength crumbled into a decaying monument to the bullish last stand above $420:

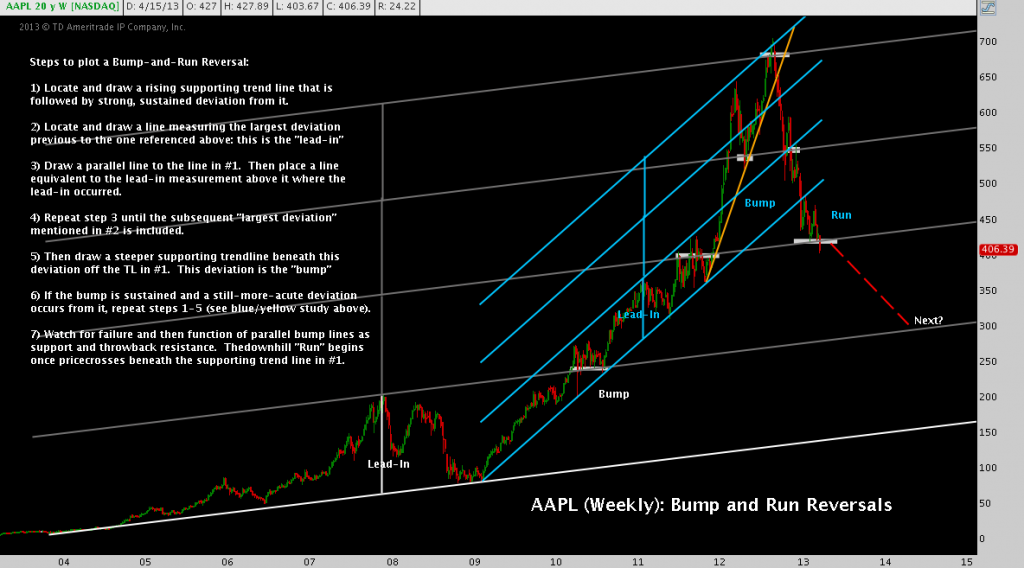

As dire as the descending triangle’s $360 target breaks, it is but a continuation in the sad saga of Apple’s long-term Bump-and-Run Reversal Top. This pattern is also snapping an important support rail today:

It’s not all bad, though. As noted, with Apple falling down aggressively, it has 1) entirely cleared the exuberance that followed 2012’s opening breakaway gap and 2) reached back to a time in 2011 when its more measured pace of advance created thick consolidation zones. The upshot: the way below $400 is thickly littered with potential footholds.

There was little that technically-derived to recommend the long side in Apple on Monday. Now, may be even less. But with the excess that is 2012 behind and visitation deeper into the stair-step support from 2011 ahead, the easy short that has benefited for months by Apple falling down appears to be over.

Twitter: @andrewunknown and @seeitmarket

Author holds no position in the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.