The current “crisis” entails the government shutdown, the possibility of debt default, and the uncertainty of the default’s impact to GDP. While many are pondering the benefits and detriments of the shutdown, I think these times offer us a unique opportunity to look beyond the headlines and more closely at a couple of the current drivers and assumptions behind the economic recovery. No doubt, the economy has been on the mend, but it been unbalanced for many. Lagging GDP and anemic wage growth have been highlights of the past few years. And this could be taking a toll on an otherwise resilient consumer.

The current “crisis” entails the government shutdown, the possibility of debt default, and the uncertainty of the default’s impact to GDP. While many are pondering the benefits and detriments of the shutdown, I think these times offer us a unique opportunity to look beyond the headlines and more closely at a couple of the current drivers and assumptions behind the economic recovery. No doubt, the economy has been on the mend, but it been unbalanced for many. Lagging GDP and anemic wage growth have been highlights of the past few years. And this could be taking a toll on an otherwise resilient consumer.

The Economy and the Consumer: Looking at the Road to Recovery

Almost a year ago, signs that the economy was improving overrode fears regarding the government debt issue and subsequent government furloughs. Wage growth within the private industry remained above the 2009 lows, which was a sign that the consumer was feeling better. Moreover, sector rotation and leadership positions for financials and cyclicals headlined the first half of this year, which was another bullet that we were in the early stages of recovery. To add to the optimism, the long-term bond market demonstrated the return of inflation when the TLT (20+ year treasury) fell below its 10/50 week ma at the New Year. The market was optimistic, not only in anticipation for a business cycle recovery, but also that return of inflation would spark enthusiasm for a renewed secular bull, now known as the Great Rotation from bonds to equities.

A Year Later, How Have the Assumptions Measured Up: A Look at Wage Growth

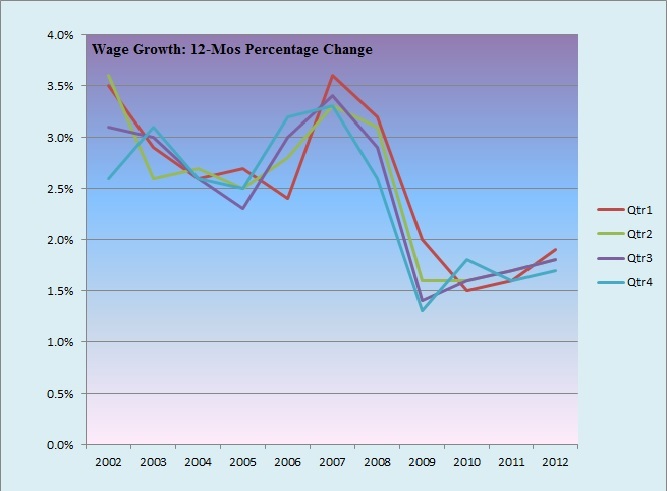

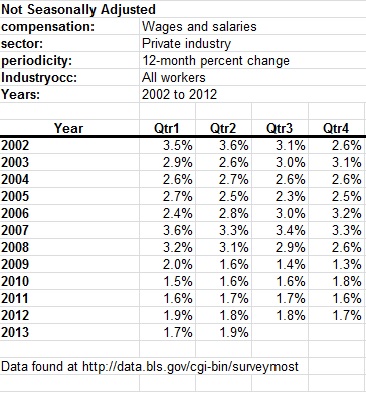

Fueling the enthusiasm, as noted above, was evidence that the long suffering consumer was on the road to recovery, demonstrated by wages off the lows of 2009. However, are we today where some may have expected us to be a year ago? You judge. By early 2007, wage growth peaked and began to head down. The end of that business cycle was exacerbated by the banking crisis that would wreak havoc on developed economies. Roller-coaster years followed, along with the never-ending debate over the QE policy adopted by the Fed to address the crisis. Still, by late 2012, the market was optimistic that the consumer was on solid ground and a ‘real’ recovery was in fact underway. Looking at the wage growth charts below with data collected by the Bureau of Labor Statistics, and adding inputs for 2013, we see wage growth dip in Q1 and rise slightly in Q2. Comparing the latter to the wage trend from 2004 to 2007, one might expect given the equity market’s trajectory that wage growth this year would be, well, less anemic.

WAGE GROWTH

Figure 1, Wages and Salaries 12-Month Percentage Change over the Last Decade

WAGE AND SALARY GROWTH

Figure 2, Table Provided by Bureau of Labor Statistics with 2013 Inputs.

Have We Simply Gotten Ahead of Ourselves

Some die-hard bulls attribute the current market volatility to the recent wrangling in Washington. They argue that we are in full recovery. While I do not question a recovery, I do question whether the enthusiasm for the recovery has gotten ahead of itself. Looking at one of the assumptions for the recovery, an improving consumer through the lens of wage growth, perhaps the market’s recent volatility represents more than simply what’s happening in Washington.

Maria’s Recommended Reading:

Ellis, Joseph H. (2005). Ahead of the Curve: A Common Sense Guide to Forecasting Business and Market

Cycles. Harvard Business School Press: Boston, MA.

Twitter: @RinehartMaria

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.