With oil prices bouncing nearly 20% off of last Wednesday’s lows, many are once again asking whether or not the bottom in Oil is truly in. My answer to that is simple: “A” bottom is in. Whether or not it is “The” bottom in oil will only be obvious in hindsight.

With prices roughly 58% from their 200 day moving average and public pessimism at levels not seen since 1998, the occurrence of a counter-trend rally is far from surprising. As history has shown us, some of the fiercest rallies occur during bear markets, of which Crude Oil most certainly remains.

With that being said, let’s look at where oil prices are currently indicating this market could be headed… assuming “a” bottom in oil is in.

From a structural perspective Crude oil remains in a strong downtrend and continues to be a “sell-strength” type environment. What’s important on the weekly chart is the potential failed breakdown below the 2009 lows that is setting up. Prices made new lows last week and quickly reversed with momentum putting in a bullish divergence on multiple time-frames. Prices also remain extended from the downtrend line drawn from the October 2014 highs, suggesting that if prices can close back above the broken support from the 2009 lows, the mean reversion in this market could accelerate and possibly retest that downtrend line. Some big “ifs” currently.

Crude Oil – Weekly Chart

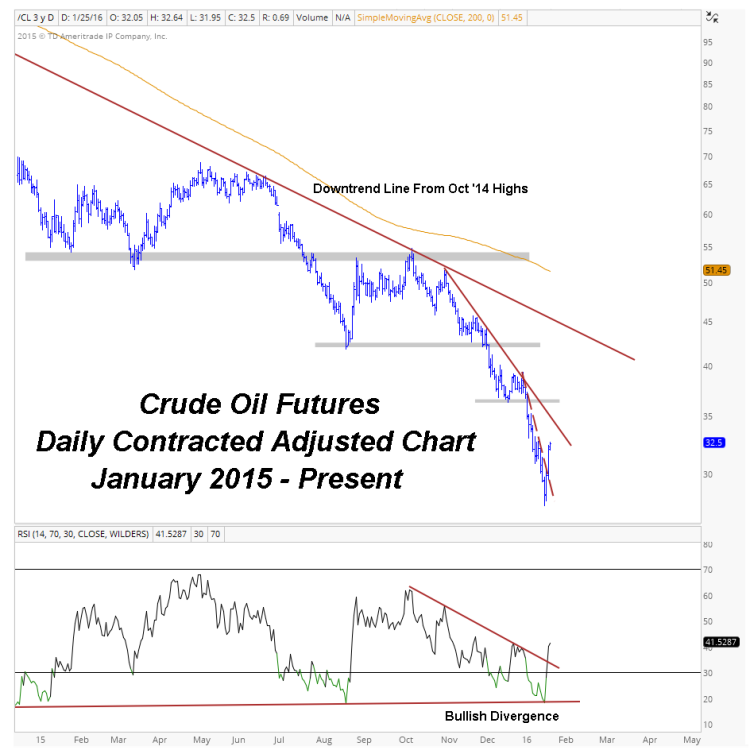

Crude Oil – Daily Chart

From a tactical perspective, oil prices were able to break above the accelerated downtrend line drawn from the year-to-date highs to confirm the bullish momentum divergence that occurred as prices made new lows. If prices can consolidate and continue higher there is potential to test the December lows, which correspond with the downtrend line drawn from the November highs, near 36.25.

Mean reversion can continue in this market, but these counter-trend rallies remain just that. Prices could rally 58% from here and still remain in a downtrend below a downward sloping 200 day moving average. So, again, “a” bottom in oil may be in, but only time will tell if/when “the” bottom is in.

More from Tom Bruni: “9 Market Themes To Watch Heading Into 2016“

Crude Oil – Hourly Chart

On previous counter-trend rallies, prices have not been able to hold their gains long enough to reverse the long-term intraday trend on the hourly chart. The 200 hour moving average is slowly beginning to flatten out and begin rising, but until it completes that reversal, it will remain difficult for crude oil prices to sustain any type of counter-trend rally for long. Looking back at previous counter-trend rallies that have occurred in this market, this intraday trend reversal has been a key indicator as to whether or not the move had any legs.

The Bottom Line: Yes, a short-term bottom is in for Crude Oil. If you’re a day trader / swing trader there is plenty of opportunity to take advantage of the mean reversion currently occurring in this market, but if you’re someone with a longer time-frame, it’s important to remember that this counter-trend rally comes within the context of a strong structural downtrend. If this proves to be “the” bottom in oil that everyone is looking for, then there will be plenty of time to participate on the long side.

I continue to think that this strong of a downtrend will take a significant period of time to reverse, and the current weight of evidence suggests this remains a market where you want to be selling strength rather than buying dips.

With that being said, if oil prices can continue to hold up and continue to the upside, likely areas of resistance will be near 36.25, 39, and 42.50, as outlined on the daily chart. This would also provide an obvious lift to those markets related / correlated to Crude Oil, such as the energy sectors in the U.S. and Russia in the global equity space. But as with any bear market rallies, investors should remain disciplined and realize that they can be short in nature.

As always, if you have any questions feel free to reach out and I’ll get back to you as soon as I can.

Twitter: @BruniCharting

The author does not have a position in any of mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.