The most coveted trade on Wall Street right now is cash and short positions designed to bet against stocks (i.e. shorting stocks or other related market instruments). The fear and anxiety that has gripped the financial markets during the nascent days of 2016 has led to a rush for capital preservation and temptation to reap profits on the downside by shorting stocks.

Just a decade ago this would have been nearly unthinkable for all but the most aggressive investors with margin agreements, options familiarity, or a contrarian viewpoint. However, the proliferation of exchange-traded funds (ETFs) that short an underlying basket of stocks have made this practice commonplace for virtually anyone with a brokerage account.

The recent ramp up in bearish sentiment combined with social aggregation of “best short ideas” has led me to question if most investors are well served in this practice. If you are considering shorting stocks or betting against the market at this juncture, it may be in your best interest to answer the following three questions first.

What are you trying to accomplish with the short trade?

Obviously if you are even contemplating buying a fund such as the ProShares Short S&P 500 ETF (SH), you believe that stocks are going to fall further. That thesis may well prove to be true. However, the most important component of a successful strategy of shorting stocks or the broader stock market via ETFs is knowing what the trade will accomplish to begin with. This will help you frame your overall risk tolerance and ensure you are taking a level-headed approach rather than being caught up in a wave of short-term fear.

Are you trying to hedge highly appreciated positions that you don’t want to sell at this juncture?

Are you mostly in cash with the intention of trying to squeeze out a few dollars on the downside?

Are you following an advisor/media/newsletter that told you to short the stock market?

I ordered those questions from least to most risky in order to properly frame the most commonplace reasons for betting against the market. If you are simply taking out a small insurance policy against a large allocation of long positions, then you are minimizing the net damage that would occur if the market turns higher.

However, if you are already in a solid position of capital defense, it may make less sense to try and push your luck. There is no worse feeling in the world than taking out a large bet against the market and seeing your capital dwindle if stocks shoot higher. This double whammy will create a wide gap in your relative performance and likely destroy your confidence alongside it.

Are you trading at an opportunistic entry point?

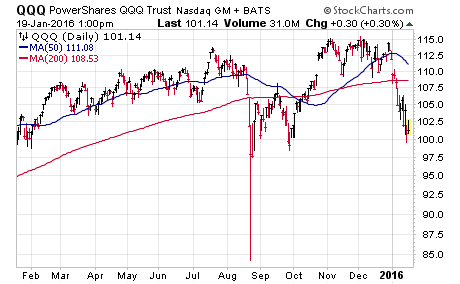

The ability to successfully short the stock market or time when to be shorting stocks (riskier) requires a counterintuitive mindset. Just as successful investors buy low and sell high, you need to be thinking short high and cover lower. As of this writing, the PowerShares QQQ (QQQ) is 14% off its 52-week high and testing the correction territory of yesteryear.

The most opportunistic place to short this index was in November or December of 2015 as it was pressing to new heights. The risk-to-reward ratio is far more dangerous down at these lows than it was back then.

Logically the market could fall much farther and still prove to be a profitable short from these levels. However, I am simply pointing out that your best opportunities on the short side should come from rallies or specific technical markers rather than after sharp drops.

What is your exit strategy in the event you are wrong (or right)?

It’s worth pointing out that when you are short the stock market you are betting against the entire system. There are many fundamental factors that are working against you the entire way, which is why it is important to know when you will exit the trade.

This could take the form of a downside target in a major benchmark that will represent a successful resolution to your trade. It could also be represented in a trailing stop loss or other sell discipline that will automatically kick in if you are ultimately wrong in your thesis, timing, or entry point.

Make sure that you identify both eventualities so that you are properly prepared for anything that comes your way.

Final Words Of Advice

There is money to be made in shorting stocks by either luck or skill. However, this practice should not be taken lightly by even the most experienced investors. Make sure that you have defined your risk parameters and fully understand the type of vehicle that you choose before you dive headlong into the fray shorting the stock market. Being nimble in this effort may be your best ally rather than trying to overstay your welcome.

Furthermore, keep in mind that any leveraged products will magnify price moves in both directions, which will create heighted volatility and overall risk.

Thanks for reading.

Twitter: @fabiancapital

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.