Solar stocks are back on the radar again. And 3 solar names in particular have caught my attention: Sunpower Corporation (SPWR), SolarCity Corporation (SCTY), and First Solar, Inc. (FSLR). Let’s take a look at few charts to illustrate why these solar stockss are on my radar.

Solar stocks are back on the radar again. And 3 solar names in particular have caught my attention: Sunpower Corporation (SPWR), SolarCity Corporation (SCTY), and First Solar, Inc. (FSLR). Let’s take a look at few charts to illustrate why these solar stockss are on my radar.

Sunpower (SPWR)

Here is a daily chart view of SPWR. As you can see, there were a few failed breakouts in January and March that led to some nasty reversals. Then you had a shakeout period in April where weak longs were taken out. Since that shakeout, the stock has set up nicely and recently broke out of a 9 month consolidation period. In the very short term it is overbought, so some profit taking should be expected.

SPWR daily stock chart:

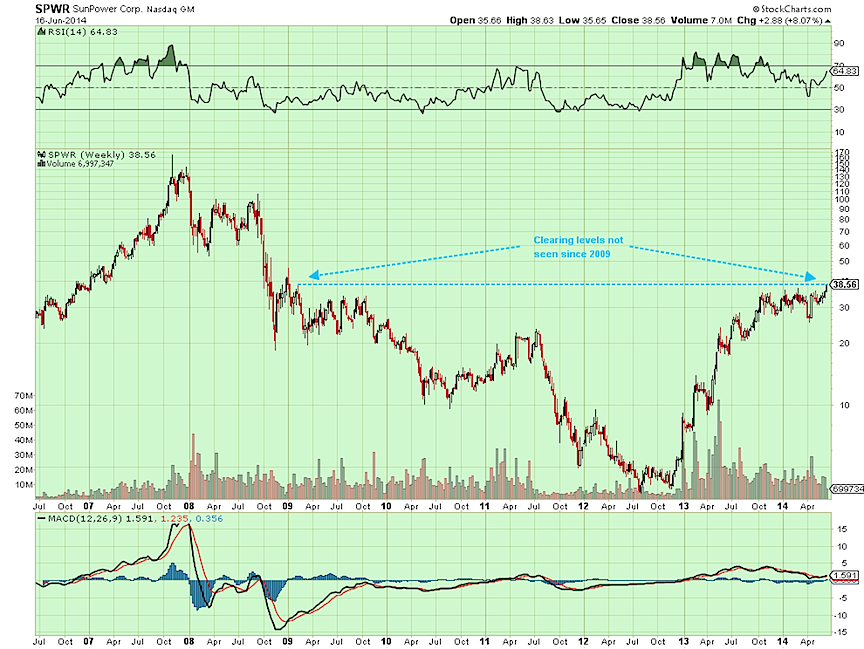

Next is a weekly chart view. The interesting thing that stands out to me is that Sunpower’s stock is clearing levels not seen since 2009.

SPWR weekly stock chart:

The stock is also coming into a seasonally strong month of July. According to historical data from paststat.com, July has been the best month to own the stock. It’s been higher on 7 of 8 occurrences (88%) with an average win percentage of 13.44%, making this one of the key solar stocks to watch this summer.

SolarCity (SCTY)

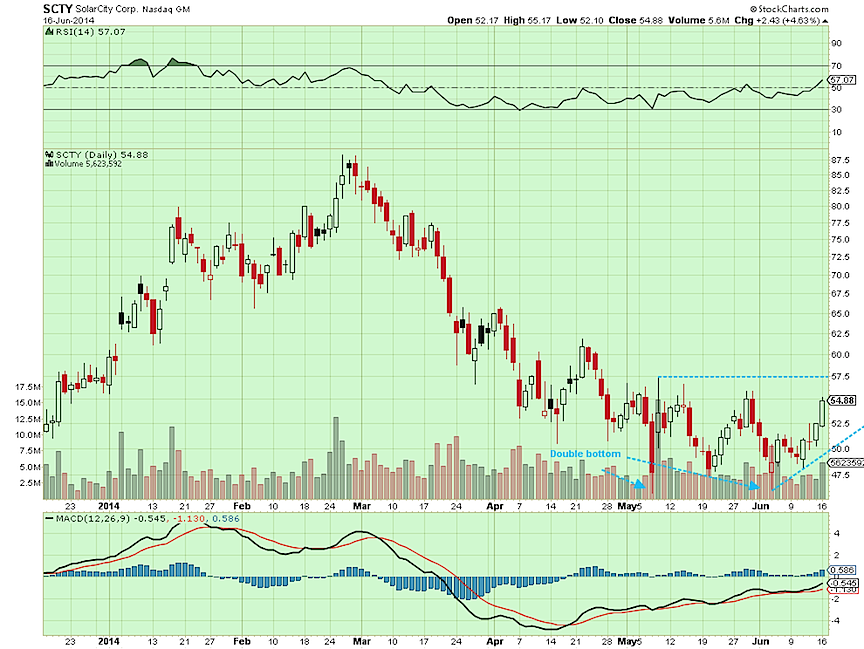

Here’s a daily chart view of SCTY. What looks interesting to me is the nice double bottom that the stock has put in. It’s also setting up for a potential breakout above the 57.50 level in the short term, with an ascending triangle pattern.

SCTY daily stock chart:

First Solar (FSLR)

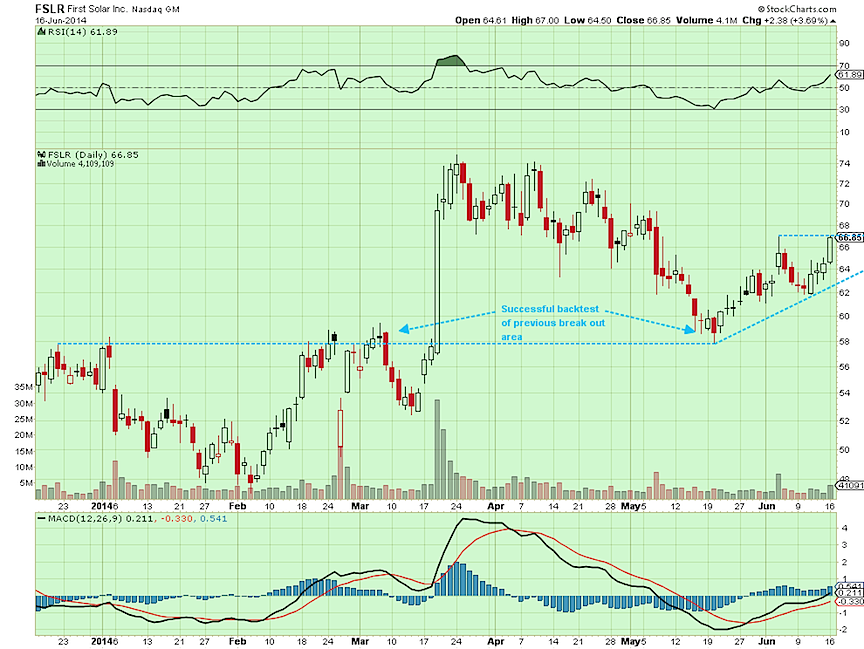

Here’s a daily look at First Solar (FSLR). The stock just recently completed a successful backtest of a previous breakout area and is now setting up for potentially higher prices, with an ascending triangle pattern.

FSLR daily stock chart:

From a seasonality perspective, the stock is in a nice 2 month sweet spot here. According to data from paststat, the stock has been higher on 5 of 7 occurrences in the month of June (71%) with an average win percentage of 12.17%. For the month of July the stock has been higher on 5 of 7 occurrences (71%) with an average win percentage of 10.76%. This reinforces why FSLR is high on my watch list of solar stocks right now.

There’s also a chance that the run in some of these solar stocks could already be over, so it’s important to have stops and honor them when they trigger. Thank you for reading.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.