2016 Government Spending Set To Rise At Fastest Rate Since 2009

Economic stimulus typically takes one of two forms: monetary policy via central banks or fiscal policy via governments. Central banks have been left to do the heavy lifting in recent years. That may be on the verge of changing – from Bloomberg:

The world’s governments are stepping up to the plate to relieve monetary policymakers of some of the burden of supporting persistently slow-growth economies, according to HSBC Holdings PLC. Around the world, government spending is poised to grow by more in 2016 than any year since 2009, when fiscal authorities embarked upon a coordinated plan of boosting expenditures to deal with the damage wrought by the financial crisis.

Does The Bullish Case For Stocks Hold Water?

Reviewing the bullish case can help us remain flexible in the event stocks decide to print new highs. This week’s stock market video compares 2016 to 2009 and 2011. Do bullish similarities exist? Will an uptick in 2016 government spending matter? You can decide.

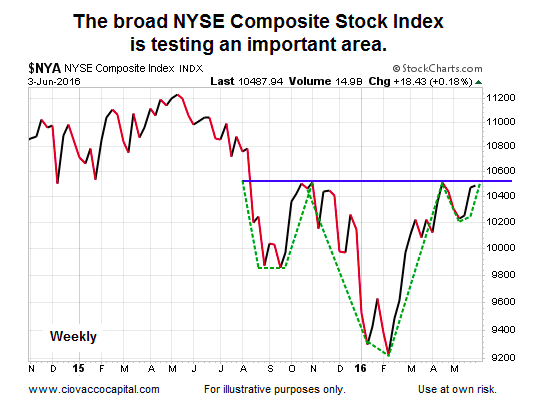

Broad Market Remains Near Inflection Point

The weekly chart of U.S. stocks tells us we are in a “it is prudent to pay close attention” mode. Given the weekly economic calendar is relatively quiet after comments from Janet Yellen Monday, it is possible stocks continue to tread water.

Thanks for reading.

More from Chris: Central Banks Gone Wild: Investing In A Time Of Uncertainty

Twitter: @CiovaccoCapital

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.