Considering the way the markets behaved during the first half of the year, it should come as no surprise that there are high levels of investor confusion surrounding the near-term direction (and theme) of the markets.

Considering the way the markets behaved during the first half of the year, it should come as no surprise that there are high levels of investor confusion surrounding the near-term direction (and theme) of the markets.

On a day-to-day basis, investor sentiment ranges from a head scratch to a high five to you gotta be kidding me. Several technical and fundamental indicators have flashed caution to no avail. And this has given way to an uncomfortable tension beneath the surface as investors try to find answers while keeping pace with performance.

Here are 10 quick reasons for investor confusion:

1. The Russell 2000 (RUT) and the Small Caps have severely underperformed all year.

2. Emerging Markets (EEM) have performed in line (up 7.0% YTD).

3. Bond yields have dropped and are depressed across several developed countries. Even more interesting is the comparison of 10 year yields – U.S. vs select European sovereigns.

- And High yield/junk bonds have been gobbled up like candy.

4. The Euro is falling / The U.S. Dollar is flat.

5. The Regional Banks Index (KRE) has traded sideways in a wide range.

6. U.S 1st quarter GDP was negative and the U.S. economy continues to slog along.

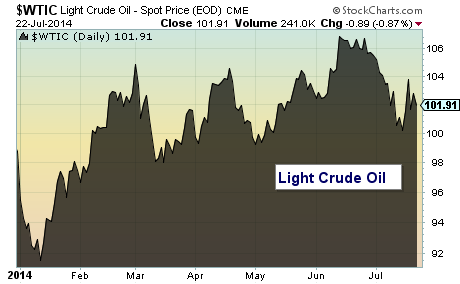

7. Crude Oil is over $100/barrel.

8. The Utilities Sector (XLU) is up 12.2% not including dividends.

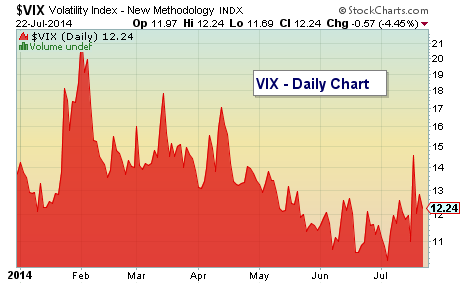

9. The Volatility Index (VIX) put on a 10-handle and is currently clocking in at 12.

10. Geopolitical drama is becoming a bigger concern. From the Syrian civil war to the NSA debacle to the Russia-Ukraine tensions to the Israeli-Palestinian conflict, major super powers are beginning to stir.

Today, the S&P 500 briefly touched new all-time highs and closed less than one percent off the momentous milestone of 2000.

For those keeping score at home, near-term risk is rising in the market place. And so are equities… invest accordingly.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.